Forex indicators without redrawing: overview of features and advantages

Forex indicators play an important role in market analysis and making trading decisions. Many traders use various indicators to predict price movements, but not all indicators are equally reliable. One of the most popular and convenient tools are non-repainting indicators. In this article, we will consider what these indicators are, their features and why they are so valuable in the market.

What are non-repainting indicators?

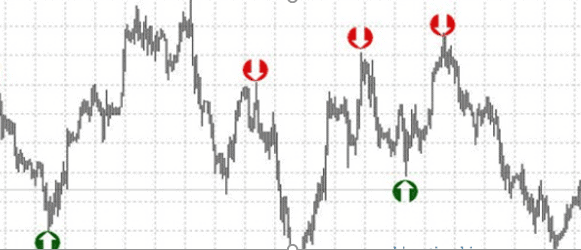

Non-repainting indicators are technical tools that do not change their values after they have been displayed on the chart. Unlike standard indicators that can “repaint” when data is updated, these indicators record the results at the moment of their formation, providing traders with an accurate picture at a given moment in time.

The main feature of such indicators is that they do not change during subsequent trading sessions. This means that a trader, based on a signal received from such an indicator, can be sure that this will not be an error caused by changes that may occur during repainting.

Benefits of Using Non-Repainting Indicators

Non-repainting indicators have several key benefits that make them attractive to traders, especially those who value accuracy and stability.

- Signal Accuracy. One of the main benefits of non-repainting indicators is that they provide more reliable signals. Since the indicator does not change its value after the bars are completed, traders can be sure that the signal they are receiving is relevant and will not change when the data is updated.

- Overcoming Data Distortion. Standard indicators that repaint can be misleading for a trader, as they change the data with each new bar, which makes the analysis more difficult and not always objective. Non-repainting indicators eliminate this drawback, providing stability.

- Better conditions for automated trading. Non-repainting indicators are especially useful for automated trading systems and advisors. They provide more accurate and stable information for making trading decisions, which allows the algorithms to work more efficiently.

How to Use Non-Repainting Indicators Correctly?

Whether a trader uses manual or automated trading, using non-repaint indicators correctly requires knowledge of their features and how they work.

Don’t rely on just one indicator. Although non-repaint indicators provide more stable signals, they are not an absolute solution. It is important to use them in combination with other analysis methods, such as support and resistance levels, trend lines, or candlestick patterns.

Understand time frames. Non-repaint indicators are especially effective on large time frames (e.g. H1, H4, D1), where signals are more stable. On smaller time frames, their effectiveness may decrease, since price movements may be more random.

Configure to your strategy. Some non-repaint indicators can be configured for different trading styles, including scalping, day trading, or position trading. It is important to adapt the indicator to your strategy and take its features into account when making decisions.

Popular Non-Repaint Indicators

There are several popular non-repaint indicators that are used by Forex traders. Here are some of them:

- RSI (Relative Strength Index) indicator. This oscillator helps to identify overbought and oversold levels in the market and provides reliable signals without redrawing.

- MACD (Moving Average Convergence Divergence) indicator. This is one of the most popular indicators, which also has non-redrawing versions, providing accurate signals for determining trends and reversals.

- ATR (Average True Range) indicator. This indicator helps traders assess market volatility and allows them to effectively manage risks when trading.

Non-redrawing indicators are powerful tools for market analysis that provide more accurate and stable signals. They eliminate the problem of redrawing, which makes them especially useful for traders seeking more confident and predictable trading decisions. Proper use of these indicators in combination with other analysis methods can significantly improve trading efficiency and minimize risks.