RRR Capital broker: review of the fraudster’s activity, customer reviews

RRR Capital company causes a lot of discussions among investors. This article will talk about negative customer reviews about RRR Capital and the way this company operates. Let’s examine their methods of dubious business and expose the “fraud”.

Unscrupulous approach of RRR Capital

Customer Reviews

Customers may leave negative reviews about RRR Capital for various reasons.

Some of them may be related to problems encountered when trading forex, such as high risks and the use of leverage.

Clients may also be dissatisfied due to the quality of the broker’s service.

This includes products and services, information and advice provided on the website.

Other reasons may be due to problems with accounts, spreads, regulation or the availability of trading instruments.

For example, metals, indices, energy, stocks, commodities.

The company must respond adequately to criticism and complaints from customers.

By providing training resources, a variety of payment methods and customer support through a team of experts.

It is important to have the necessary licences to provide suitable solutions to clients in accordance with the laws of the jurisdiction.

Scammers’ modus operandi

Scammers use fake websites and promise easy profits. They are unlicensed and unregulated. They often offer non-existent products, high financial risk and too high leverage.

Signs of fraud include lack of licence information, misleading training materials and limited payment methods.

RRR Capital provides a variety of account types, but always pay attention to regulation and licences.

It is important to be alert to risks, research information and services to avoid fraud.

Artificial losses and customer deception

RRR Capital pretends to create losses for clients. They offer high risk and leveraged accounts like ECN Pro Account or VIP Account. This can lead to losing money without the right support and risk information. The fraudulent scheme includes false information about the company’s products and licences. RRR Capital may promise training, but they don’t keep their word. In the end, due to high risk and lack of support, the company may not pay out to its clients.

Lack of payouts

Payouts from RRR Capital can often be delayed for a variety of reasons: account accounting errors, failure to comply with regulations, or lack of customer support. Also, the risks of Forex trading, the use of high leverage and lack of knowledge about brokerage services can affect delayed payouts. To identify the reason for delays, you should research the licences, regulation and information about the company on their official website.

In case of delayed payments from RRR Capital, it is recommended to contact the regulator or supervisory authorities, discuss the issue with customer support and provide additional evidence if necessary.

Characteristics of RRR Capital

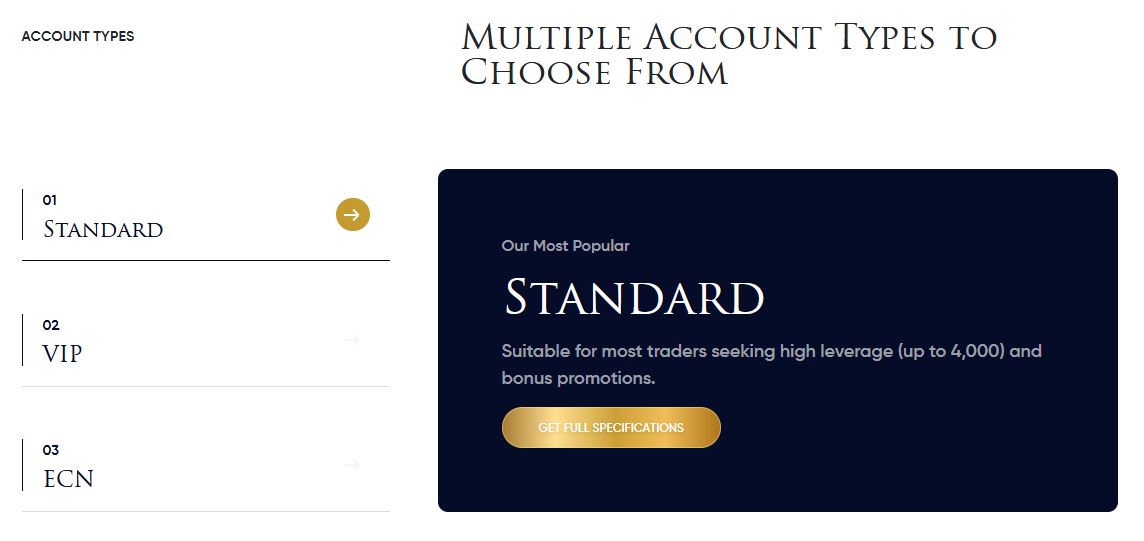

Account Types

RRR Capital offers clients two types of accounts:

- Standard account and.

- VIP account.

Standard account requires a minimum deposit and gives access to various instruments including metals, stocks and other commodities.

The VIP account, also available, offers clients high leverage and more assets to trade.

RRR Capital has the necessary licence and regulation from the jurisdiction of Mauritius to ensure client safety.

Clients can avail training materials and various deposit and withdrawal methods.

RRR Capital’s support team is ready to assist clients with any questions or concerns while using the MT5 trading platform.

Trading Conditions

RRR Capital offers different types of accounts:

- Standard account

- VIP account

They have minimum deposits to meet the needs of the clients.

The company’s website has:

- A wide range of trading instruments

- Metals, indices, energy, stocks, commodities

Also available:

- High leverage to increase potential profits

- Reliable regulation and licences

They have licence:

- 200908 from the Financial Services Commission of Mauritius

Clients can:

- Take advantage of educational resources

- Use a variety of payment methods

- Contact the support team for advice and information

All this to trade on the MT5 platform.

Follow and trade

RRR Capital offers clients different types of accounts:

- Standard account

- VIP account

Each account has its own features and minimum deposit.

In a standard account, clients have access to trading instruments such as metals, indices, energy, stocks and others.

ECN Pro Account offers more advanced features with high leverage to help manage risk and trade with higher volumes.

Clients can get training materials and advice from the support team to achieve their goals.

RRR Capital is licensed and regulated by the Mauritius jurisdiction, ensuring safety and security in trading operations.

Promises and values of RRR Capital

Company Goals

RRR Capital’s objectives are:

- Providing a wide range of accounts, products and services.

- Providing different types of accounts: ECN Pro Account, Standard Account and VIP Account.

- Providing high leverage for risk management in trading.

- Providing educational resources and advice on products and services.

- Support customers through customer service, training programmes and various payment methods.

- Possession of licences and regulation by financial services authorities.

RRR Capital guarantees the legality of products and services in accordance with the jurisdiction’s requirements.

Promises to clients

RRR Capital promises clients a wide range of accounts: standard and VIP. Minimum deposit and high leverage for Forex trading.

The broker offers a variety of trading instruments: metals, indices, energy, stocks and other commodities.

RRR Capital has all the necessary licences and regulation as it is a legal licensee under the name of RRR Markets Limited in Mauritius.

The company offers training resources, various payment options and a support team for trading and risk advice and assistance.

RRR Capital values security and customer satisfaction and endeavours to suitably allocate products and services according to the needs and objectives of its clients.

Client Support

RRR Capital provides customer support through several communication channels: online chat, email and telephone.

The support covers various questions about the company’s products and services, such as accounts, brokerage services, trading instruments and Forex risks.

RRR Capital trains its employees to solve problems and satisfy customers. The company provides educational materials about regulation and licensing.

Clients can choose between different types of accounts – ECN Pro Account, Standard Account, and VIP Account. They also have a variety of deposit and withdrawal options.

Customer Experience and Negative Reviews

The customer experience with RRR Capital has been mixed.

The company offers different types of accounts such as ECN Pro Account, Standard Accounts, and VIP Accounts.

However, clients often encounter service issues.

Contacting the support team for information and advice on products and services can be difficult due to inadequate support.

Problems with the MT5 platform and poor quality of training materials are also noticeable.

Negative aspects of the customer experience are compounded by high risk and leverage levels.

This may not meet the needs of clients.

The lack of licence from an important jurisdictional authority such as RRR Markets Limited in Mauritius with licence number 200908 from the MFSC also causes customer dissatisfaction.

How does the scammer RRR Capital work?

RRR Capital scammer deceives people by offering to invest money with the promise of high returns, then disappears with clients’ funds. It is recommended to check licences and references, avoid suspicious investment schemes.

Why does RRR Capital have so many negative reviews?

“RRR Capital may have many negative reviews due to lack of communication with clients, poor customer service or delays in processing applications.”

What are some signs that RRR Capital is a fraudulent company?

RRR Capital’s lack of a licence, unfounded promises of high returns, inaccessibility of information about the company and its activities, and negative customer reviews are signs of a fraudulent company.

What protection mechanisms do clients have against negative actions of RRR Capital?

The following protection mechanisms are available to RRR Capital clients: use of two-factor authentication, data encryption, transaction monitoring and blocking of suspicious transactions.

How can clients prevent fraud by RRR Capital?

Clients should check RRR Capital’s licence and reputation, avoid prepayments and suspicious requests for personal information, and use two-factor authentication.